- Discussions/

- #15/

Recommendations for Kintsugi's DeFi-Hub Launch

NOTE: This post has been edited to update the suggestions for the pools and lending markets for the launch, in order to reduce scope and ensure a timely shipping of the DeFi Hub.

TL;DR

Interlay is becoming a one-stop-shop for all things Bitcoin DeFi, launching a DEX and lending protocol. It is proposed that the DEX and lending protocols first launch on Kintsugi, Feb/March 2023. This proposal outlines the suggested DEX pools and lending markets. Possible DEX incentives, to be covered by the Kintsugi treasury, are also outlined for community reviewIntro

As a preparation for the launch of Kintsugi's DeFi hub (https://tinyurl.com/InterlayRoadmap), this post aims to kick off a community discussion around the suggested structure of the decentralised exchange (DEX), the lending markets and parameters as well as possible liquidity incentives provided by the network treasury.DEX

Launching with only 6 pools to concentrate liquidity into key assets: kBTC, KSM, USDT, MOVR and liquid staking derivatives (LSDs) is suggested.

Lending

Just like the design of the AMM focuses on high quality tokens, this is even more true for the lending markets, which rely on battle tested and liquid assets for the safety of the protocol and its users. Pools containing the aforementioned tokens are supposed to provide sufficient liquidity to ensure liquidations.

Incentives

To achieve deep liquidity for those assets, this proposal suggests that the community considers allocating treasury funding towards liquidity programs. To that end, the program would deploy 190,000 KINT over the course of 3 months. There are discussions around applying for a grant from the Kusama treasury to support liquidity bootstrapping, although applications are currently on hold with no clear timeline due to some legal updates to the program.

Design

DEX

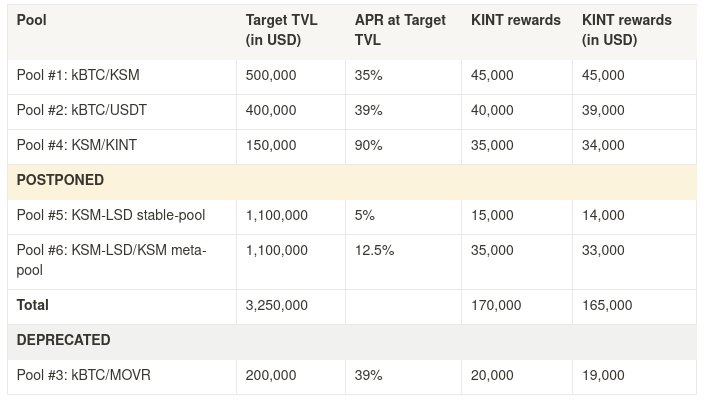

The pools were designed with the following considerations in mind: minimise slippage for the most demanded assets, minimise risks for LPs and maximise trading volume. See https://tinyurl.com/InterlayDEX for a diagram of interconnection and order flows. Pairs with high trading volume will generate higher yield for LPs and contribute to a sustainable relationship between traders and LPs, reducing the requirement for incentives. An overview of the suggested pools, incentives, and target size can be found in the following table.

According to feedback from the community, the KINT/MOVR pool has been exchanged in favor of a KSM/KINT pool.

Pool #5 is a curve stable pool and will be composed of LKSM, wstKSM, vKSM and sKSM. Pool #6, the KSM-LSD/KSM meta-pool, will allow users to swap KSM into any LSD and vice versa. Due to additional development work needed in order to implement these pools, they will not be live at launch.

Lending

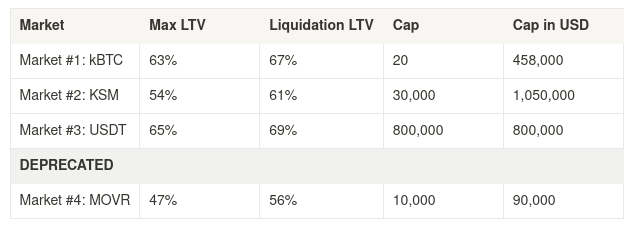

Of all available tokens in the Kusama ecosystem, the ones below were identified as being secure and liquid enough to serve as collateral. The max loan-to-value (LTV) ratio enforces the maximum borrowable amount against a user's collateral. If the user's LTV rises above the liquidation LTV, the position can be liquidated. To limit potential damage to user and protocol, the following supply caps are suggested.

Please note, that the suggested max LTV for USDT is close to the liquidation LTV. While this can be a risk for the user, it also improves capital efficiency without adding risk for the protocol. Should a lower max LTV be set to protect the user?

LSDs, including LKSM, vKSM, wstKSM, and sKSM have high demand but lack sufficient liquidity and/or a price feed from DIA or other oracle providers, exhibiting oracle manipulation attack vectors. There is ongoing work with DIA to improve sourcing prices for all LSDs. In addition, the liquidity of LSDs is expected to improve through the LSD-stable-swap pool in anticipation of adding these assets as borrowing collaterals soon.

Annex

This part is for the more interested reader and elaborates the process and results of the proposal in more detail.DEX

While swaps from token A into token B can be routed through multiple pools behind the scenes without affecting the UX of a trader, LPs face a more complex decision process. Some of the key factors that influence an LPs decision are:

- Risks associated with the LP position (volatility, protocol risk, centralization risk, etc.)

- Availability of the token (free float market cap, access within the ecosystem, etc.)

- Utilisation of the pool (real yield from trading fees)

- Alternative investments (other pools or staking)

This proposal focuses on assets that are widely available in the Kusama ecosystem and have shown to create sustainable volumes on other DEXs. The main factors for determining the amount of incentives were the target TVL, as well as the volatility of the token pair. While kBTC/KSM, kBTC/USDT, and kBTC/MOVR have similar annualised volatility in the range of 64% to 72%, KINT/MOVR requires a much higher APR to compensate LPs for the 146% volatility (the same holds true for KINT/USDT or KINT/KSM).

For stable pools, the expected volatility is close to zero. In addition, LPs of the LSD stable pool already generate staking rewards which further reduces the necessity for a high pool APR. For the LSD-KSM meta-pool however, LPs have to give up half of the yield generated via LSDs and thus will likely require a higher, competitive APR.

Incentives

The treasury has remained largely untouched, with only a few minor payouts for grants and liquidity incentives on other DEXs: more than 2.48 million KINT remain out of the initial 2.5 million. The recent reduction of Vault rewards has allocated an additional ~230,000 KINT to the treasury budget. Allocating 165,000 KINT to ensure a successful launch and liquidity boost for Kintsugi's DEX seems like a useful spending strategy. In addition to attracting liquidity, these incentives should also serve to encourage higher kBTC bridging volumes.

Lending - Risk Parameters

The estimates for the LTV thresholds that were shown above, were estimated using the same methodology as for the vault collateral, with the same scrutiny and considerations in mind: to safeguard the protocol and its users by ensuring full coverage of the underlying loans. The repository used to arrive at those estimates is publicly available for everyone to confirm the presented estimates or suggest changes to the parameters. A more in-depth description of the methodology and process can be found in the repository: https://github.com/interlay/collateralization-analysis

All thresholds, except for USDT, are estimated against USDT as being the debt, since most loans will likely be raised in USDT. USDT thresholds were estimated against BTC as collateral.

For the launch the analysis outputs a close factor of 50% and a liquidation premium of 110%. This means that a liquidator can close up to 50% of a borrower's position and will receive 110% worth of collateral for the liquidated debt. This should ensure that liquidations are profitable even for larger positions while limiting the potential loss for the borrower. tested. To build up a reserve fund to cover bad debt, 20% of the liquidated amount will go to the treasury's ‘bad weather fund’. Note that for severe under-collateralization, the close factor may cause multiple liquidation transactions to be necessary for clearing bad debt.

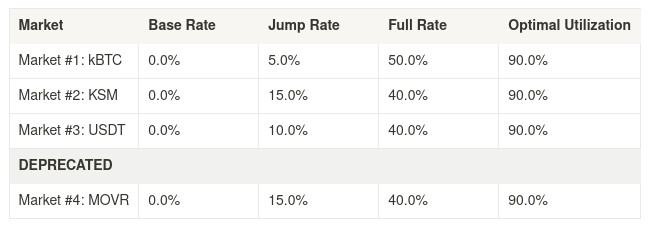

Lending - Interest Parameters

Following from the above, the proposed calibration of the interest rate parameters at launch is as follows:

Based on the analysis of these exact markets on other protocols, the parameters should, on average, maintain a utilisation close to the optimal rate of 90%. Utilisation close to this rate will limit the spread between supply and borrow rates while maintaining sufficient exit liquidity for suppliers. If the utilisation diverges too much from the optimal rate, this usually creates arbitrage opportunities with other lending protocols.

- Which protocols support LKSM, wstKSM, vKSM and sKSM, on which chains are there? Are the teams known and trusted?

- Why are you suggesting to pair KINT with MOVR? It would seem more natural to pair it with KSM, since one obvious use case is reinvesting KINT rewards

- What is the mechanism by which the reward tokens are paid out in the LPs? Often there is a fixed amount per day, which gives insane yields in the early hours but quickly drops after a few days.

To be honest, I guess that you know better than me, I'm just wanna wish you the best. Working hard! Moving forward!!!

personally, I'd swap the KINT-MOVR pool for KINT-KSM because that's the pair that vaults will use for cycling rewards (disclaimer: I'm a vault operator). Otherwise everything else looks good.

@a3cF...AjJw

Which protocols support LKSM, wstKSM, vKSM and sKSM, on which chains are there?

-> LKSM: Acala team on Karura, wstKSM: Lido team via Moonriver, vKSM Bifrost team on Bifrost, sKSM Parallel team on Heiko.

Although individual perception might differ, we assessed all projects and their respective LSD tokens as trustworthy. Also it should be emphasized that the risk of failure of one of the protocols would not impact the safety of Kintsugi or kBTC but would remain with the holders (LPs) of those tokens. Only when those LSDs are whitelisted as collateral to mind kBTC or in the lending protocol would the protocol be at risk in case of a failure.As I already stated in the post, swapping KINT for KSM does not require a KINT/KSM pool but can be easily done via multi-hop swaps without impacting the UX. Hence, I suggest we should focus the discussion more on potential LPs of pools rather than on order flow, to attract as much capital as possible to minimize slippage. Some arguments I see in favor of KINT/MOVR pool is that (a) Potential IL for KINT/MOVR is likely lower and (b) with KSM LPs face the choice to stake for ~20% APR with no IL risk. This means that the APR needs to be somewhat higher compared to when paring KINT with MOVR which is probably hard to sustain without incentives.

The rewards are paid out on a per block basis with a fixed amount per block. This means what you described will also the case on our DEX. We have seen that this does actually attract more capital in a shorter time than starting with a low APR and increasing it over time. This strategy failed miserably on Arthswap for INTR/DOT and iBTC/DOT.

Great detail. Thanks team. Couple points:

I also think the KSM/KINT pool would be better to attract liquidity vs KSM/MOVR. I noted the point about stakers of KSM getting 20% and no IL but that is also the same for MOVR stakers give or take a couple of %. Given the nature of the user base of Kintusigi, i think KSM pair is much more appealing and would be able to achieve the target TVL quicker especially given the APY.

For the borrowing and lending I am assuming that any collateral can be used to borrow any asset? I think the Max TVL vs liq TVL are good and USDT doesn't need to be changed to protect the user I think putting the risk management in the hands of the users is better.

'To build up a reserve fund to cover bad debt, 20% of the liquidated amount will go to the treasury's ‘bad weather fund’ - Not quite following this? Where does this 20% come from? If the liquidator is taking 50% [+ premium] of the position is this 20% coming from the other 50%? In which case that's a large cost to be liquidated? 10% to the liquidator and 20% to the treasury?

@a3eJ...o5NA

Thanks for your input.

Re 3.: The liquidator can at max close 50% of the borrowers position. For the closed amount, the liquidator will receive 110% of the debt value in the form of collateral, which implies a 10% premium. The 20% which go to the DAO for a 'bad weather fund' are in relation to the 20% premium, such that the liquidator will effectively get 108% of the closed debt value and the DAO get's 2%.

We are already looking into smaller or dynamic closing factors, to avoid unnecessary costs for the borrower.

NOTE: The above post has been edited to update the suggestions for the pools and lending markets for the launch, in order to reduce scope and ensure a timely shipping of the DeFi Hub.